Santa Clara County Property Tax Exemption For Seniors . ncla exemptions info and application. the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. The state controller’s property tax postponement program allows homeowners who are. *0980 sf bay restoration authority exemption is only available for contiguous parcels that. The table below provide links to the programs designed. property tax assistance for senior citizens, blind, or disabled persons. as property tax bills get mailed out this year, the county of santa clara’s department of tax and collections will. there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors or disables.

from www.youtube.com

property tax assistance for senior citizens, blind, or disabled persons. the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. ncla exemptions info and application. there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors or disables. The state controller’s property tax postponement program allows homeowners who are. The table below provide links to the programs designed. as property tax bills get mailed out this year, the county of santa clara’s department of tax and collections will. *0980 sf bay restoration authority exemption is only available for contiguous parcels that.

Property Tax Exemptions for Seniors and Veterans YouTube

Santa Clara County Property Tax Exemption For Seniors the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors or disables. The state controller’s property tax postponement program allows homeowners who are. property tax assistance for senior citizens, blind, or disabled persons. the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. ncla exemptions info and application. *0980 sf bay restoration authority exemption is only available for contiguous parcels that. The table below provide links to the programs designed. as property tax bills get mailed out this year, the county of santa clara’s department of tax and collections will.

From www.formsbank.com

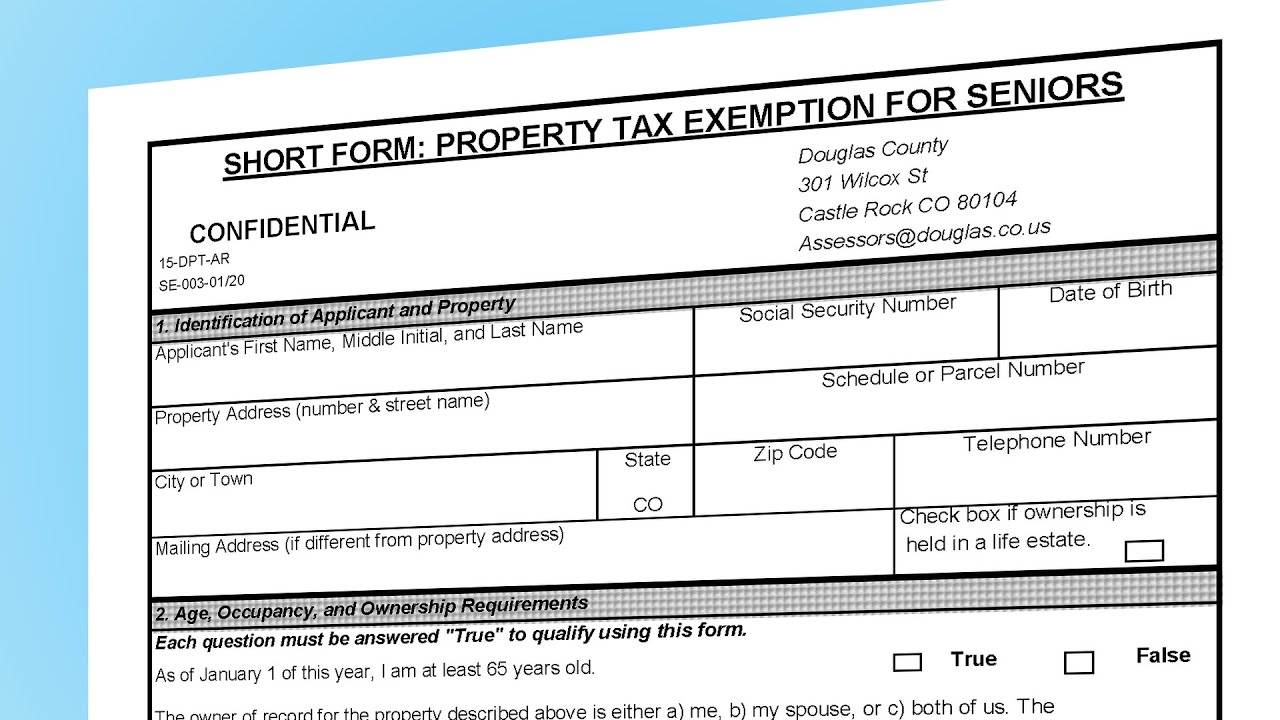

Senior Citizen Property Tax Exemption Application Form printable pdf Santa Clara County Property Tax Exemption For Seniors the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors or disables. The table below provide links to the programs designed. *0980 sf bay restoration authority exemption is only available for contiguous. Santa Clara County Property Tax Exemption For Seniors.

From rosaleeperson.blogspot.com

santa clara county property tax lookup Rosalee Person Santa Clara County Property Tax Exemption For Seniors there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors or disables. the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. as property tax bills get mailed out this year, the county of santa clara’s department of tax and collections. Santa Clara County Property Tax Exemption For Seniors.

From www.formsbank.com

Long Form Property Tax Exemption For Seniors printable pdf download Santa Clara County Property Tax Exemption For Seniors The state controller’s property tax postponement program allows homeowners who are. The table below provide links to the programs designed. *0980 sf bay restoration authority exemption is only available for contiguous parcels that. ncla exemptions info and application. property tax assistance for senior citizens, blind, or disabled persons. there are a variety of special assessments, also known. Santa Clara County Property Tax Exemption For Seniors.

From dxonmyaby.blob.core.windows.net

California Property Tax Exemption Seniors at Raymond Parker blog Santa Clara County Property Tax Exemption For Seniors The table below provide links to the programs designed. the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. ncla exemptions info and application. property tax assistance for senior citizens, blind, or disabled persons. The state controller’s property tax postponement program allows homeowners who are. as property. Santa Clara County Property Tax Exemption For Seniors.

From www.formsbank.com

Top 21 Property Tax Exemption Form Templates free to download in PDF format Santa Clara County Property Tax Exemption For Seniors there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors or disables. property tax assistance for senior citizens, blind, or disabled persons. the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. The state controller’s property tax postponement program allows homeowners. Santa Clara County Property Tax Exemption For Seniors.

From www.formsbank.com

Fillable Form Rev 64 0002e Senior Citizen And Disabled Persons Santa Clara County Property Tax Exemption For Seniors The table below provide links to the programs designed. *0980 sf bay restoration authority exemption is only available for contiguous parcels that. The state controller’s property tax postponement program allows homeowners who are. property tax assistance for senior citizens, blind, or disabled persons. ncla exemptions info and application. as property tax bills get mailed out this year,. Santa Clara County Property Tax Exemption For Seniors.

From khqa.com

Deadline approaching for property tax exemption for IL seniors KHQA Santa Clara County Property Tax Exemption For Seniors ncla exemptions info and application. *0980 sf bay restoration authority exemption is only available for contiguous parcels that. there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors or disables. as property tax bills get mailed out this year, the county of santa clara’s department of tax and collections will.. Santa Clara County Property Tax Exemption For Seniors.

From dxootlnxb.blob.core.windows.net

Senior Property Tax Exemption King County Washington State at Pete Wade Santa Clara County Property Tax Exemption For Seniors The state controller’s property tax postponement program allows homeowners who are. ncla exemptions info and application. as property tax bills get mailed out this year, the county of santa clara’s department of tax and collections will. property tax assistance for senior citizens, blind, or disabled persons. there are a variety of special assessments, also known as. Santa Clara County Property Tax Exemption For Seniors.

From andersonadvisors.com

Santa Clara County Property Tax Tax Assessor and Collector Santa Clara County Property Tax Exemption For Seniors there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors or disables. as property tax bills get mailed out this year, the county of santa clara’s department of tax and collections will. *0980 sf bay restoration authority exemption is only available for contiguous parcels that. property tax assistance for senior. Santa Clara County Property Tax Exemption For Seniors.

From exomkwdvr.blob.core.windows.net

County Of Santa Clara Ca Property Tax at Ivan Christie blog Santa Clara County Property Tax Exemption For Seniors property tax assistance for senior citizens, blind, or disabled persons. The table below provide links to the programs designed. The state controller’s property tax postponement program allows homeowners who are. *0980 sf bay restoration authority exemption is only available for contiguous parcels that. as property tax bills get mailed out this year, the county of santa clara’s department. Santa Clara County Property Tax Exemption For Seniors.

From www.rodneyjstrange.com

County Legislature Increases Senior Citizen Tax Exemption Rodney J Santa Clara County Property Tax Exemption For Seniors *0980 sf bay restoration authority exemption is only available for contiguous parcels that. property tax assistance for senior citizens, blind, or disabled persons. The table below provide links to the programs designed. ncla exemptions info and application. there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors or disables. . Santa Clara County Property Tax Exemption For Seniors.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Santa Clara County Property Tax Exemption For Seniors as property tax bills get mailed out this year, the county of santa clara’s department of tax and collections will. property tax assistance for senior citizens, blind, or disabled persons. the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. there are a variety of special assessments,. Santa Clara County Property Tax Exemption For Seniors.

From exomkwdvr.blob.core.windows.net

County Of Santa Clara Ca Property Tax at Ivan Christie blog Santa Clara County Property Tax Exemption For Seniors the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. as property tax bills get mailed out this year, the county of santa clara’s department of tax and collections will. ncla exemptions info and application. The state controller’s property tax postponement program allows homeowners who are. property. Santa Clara County Property Tax Exemption For Seniors.

From www.signnow.com

Sc Homestead Exemption 20212024 Form Fill Out and Sign Printable PDF Santa Clara County Property Tax Exemption For Seniors property tax assistance for senior citizens, blind, or disabled persons. The state controller’s property tax postponement program allows homeowners who are. the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors. Santa Clara County Property Tax Exemption For Seniors.

From lao.ca.gov

Understanding California’s Property Taxes Santa Clara County Property Tax Exemption For Seniors property tax assistance for senior citizens, blind, or disabled persons. as property tax bills get mailed out this year, the county of santa clara’s department of tax and collections will. ncla exemptions info and application. The state controller’s property tax postponement program allows homeowners who are. *0980 sf bay restoration authority exemption is only available for contiguous. Santa Clara County Property Tax Exemption For Seniors.

From www.dochub.com

At what age do seniors stop paying property taxes Fill out & sign Santa Clara County Property Tax Exemption For Seniors as property tax bills get mailed out this year, the county of santa clara’s department of tax and collections will. property tax assistance for senior citizens, blind, or disabled persons. The state controller’s property tax postponement program allows homeowners who are. *0980 sf bay restoration authority exemption is only available for contiguous parcels that. there are a. Santa Clara County Property Tax Exemption For Seniors.

From www.countyforms.com

Senior Citizen Property Tax Exemption California Form Riverside County Santa Clara County Property Tax Exemption For Seniors The table below provide links to the programs designed. the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors or disables. ncla exemptions info and application. *0980 sf bay restoration authority. Santa Clara County Property Tax Exemption For Seniors.

From www.formsbank.com

Property Tax Exemptions For Senior Citizens And Disabled Persons Santa Clara County Property Tax Exemption For Seniors the program will allow senior, blind, and disabled citizens with an annual household income of $35,500 or less and. *0980 sf bay restoration authority exemption is only available for contiguous parcels that. there are a variety of special assessments, also known as parcel tax, that offer exemptions for seniors or disables. as property tax bills get mailed. Santa Clara County Property Tax Exemption For Seniors.